Two years after the Minnesota Legislature passed the first-ever dedicated tax source for transit in the Twin Cities, hailed by advocates as a historic move to expand and support transit, a proposal deep inside Gov. Tim Walz’s budget proposal would use that regional tax to reduce state support for transit.

Transit and environmental advocates who pushed for the three-quarters of a cent sales tax in the seven-county region in 2023 are not pleased.

“This proposal would drastically undermine the promised expansion of bus service and Bus Rapid Transit throughout the metro area which was a centerpiece of the historic 2023 Transportation Bill,” stated a letter from 15 organizations, including the Sierra Club, Our Streets, Move Minnesota and the Bicycle Alliance of Minnesota. “The Legislature must defend its historic victory for equity and climate from the Governor’s proposed rollback.”

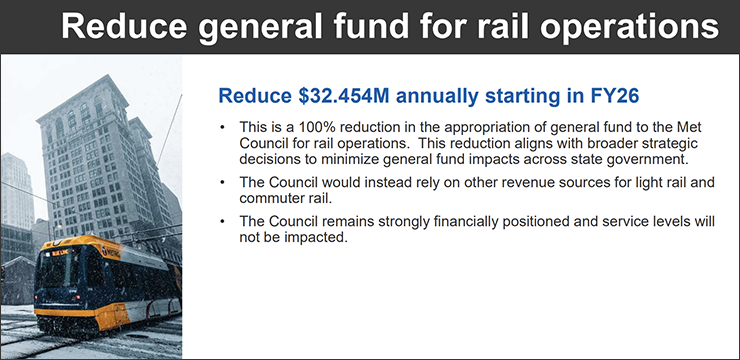

In presenting the proposal to the Senate Transportation Committee Wednesday, Met Council Chair Charlie Zelle said it was part of budget pruning Walz says is needed to keep the next two budgets balanced. The proposal would cut the transfer of $32 million a year in general funds to Metro Transit for rail operations.

“As a cabinet member, I’m fully aware of the stresses on the general fund, particularly in the next biennium, Zelle said. “We know the governor has to make tradeoffs. So choosing this reduction to this agency is one we accept and can manage without compromising the integrity of the operations.”

But Zelle acknowledged the disconnect that might be caused by him asking for less money from the Legislature.

“You will not often see a commissioner or a cabinet member come forward and advocate a reduction in revenue for an important service,” Zelle said. “But for the additional funds the Legislature has authorized for Metro Transit two years ago, we would not be able to sustain a reduction in general fund support for rail operations.”

While Zelle said the council will be able to absorb the reduction in state support in the short term without impacting rail or transit service, that pledge isn’t as clear in the longer term.

“It will certainly impact in the long term the funds that would be helpful as we want to expand additional (arterial bus rapid transit) or transitways or frequency of our service, but in the near term we believe it does not have a negative impact on our operations or our aspirations.”

The 2023 bill called for revenue from the 0.75% tax collected in the seven metro counties to be shared. The Met Council would get 83% of it for transit and “active transportation,” which includes biking, walking and rolling. The seven counties would get 17% for wider transportation needs decided by each county.

The Met Council’s 83% share of the tax raised about $417 million in 2024 and is projected to be $474 million by 2028. It is being used to both build new transit lines and increase service and frequency on existing lines. The increase ended the Met Council funding gaps for transit that had been resolved temporarily by special appropriations from the state and from federal pandemic relief money.

Metro Transit is set to open three new bus-based transit projects this year, the Gold Line, the B Line and the E line. Each will require operations subsidies, but Zelle said the council has enough to cover those costs.

- The Gold Line is a 10-mile line that will run along I-94 from St. Paul to Woodbury with connections in Maplewood, Landfall and Oakdale that will start service in March.

- The B-line is an arterial bus rapid transit line from France Street in Minneapolis to downtown St. Paul along Lake Street, Marshall Avenue and Selby Avenue that will start service in June.

- The E-Line is an arterial rapid transit line from Westgate Station on University Avenue to the Southdale Transit Center connecting the University of Minnesota, downtown Minneapolis, Uptown and France Avenue that will start service in December.

Senate Transportation Committee Chair Scott Dibble, D-Minneapolis, said he has not decided whether to support the reduction and understands the budgetary pressures on Walz. He was the co-author along with then-House Transportation Committee Chair Frank Hornstein of the sweeping transportation bill that included the regional transportation sales tax as well as other revenue sources such as the delivery fee — the so-called Amazon fee — and creating automatic gas tax increases tied to inflation.

But both the makeup of the Legislature and the state’s overall budget outlook has changed significantly since that transportation bill passed under a DFL state government trifecta. While Walz remains in office and the DFL maintains a one-vote majority in the Senate, the Minnesota House is expected to be tied.

Meanwhile, the state budget needs to be tightened, and the transportation budget has its own pressures. There are already 70 bills referred to the transportation committee, and half call for new spending, Dibble said.

“We’ll really need to sharpen our pencils,” Dibble said. But he added that he is concerned with putting too many burdens on the regional sales tax and worries that the cut in state support could create problems later.

Sen. John Jasinski, the Faribault Republican who has been co-chair of the transportation committee while the Senate has been tied 33-33, said ending state support for light rail has been a GOP position, and the Walz proposal syncs up with that. But he said his preference would be to devote the $32 million savings to statewide transportation needs, not general state spending.

“With the 0.75% sales tax they’re flush with cash,” said Jasinski, who described himself as a “rural guy.” “My thing is they’re overtaxing metro residents, but if they’re gonna use it on their stuff, I guess that’s positive for me.”

Peter Wagenius, legislative and policy director for the Sierra Club North Star Chapter that co-signed the letter, said the Walz administration was not initially supportive of the 0.75% metro sales tax, proposing instead a one-eighth of one percent tax. That, Wagenius said, wouldn’t have barely covered the Metro Transit funding deficit and left nothing to expand transit and non-motorized services.

“We know it was the Legislature that led on climate action, including on this bill,” he said. “The administration did not propose a transportation bill anywhere near as robust as what the Legislature passed.”

Wagenius said the proposal to zero out state support for rail operations “reflects the governor’s priorities, and we need the Legislature to stand up for their priorities because they place a higher value on real climate action.”

State support for light rail operations was based on a principle that while the Twin Cities region should pay for a large share of light rail and regional buses, the state has a role as well, Dibble said, comparing it to the state support for state, regional and local roads and bridges.

The state contribution for light rail operations is part of a funding arrangement that goes back two decades to the opening of the first rail line, the Blue Line between downtown Minneapolis and the Mall of America. While federal transit money provided the largest share of construction costs, the annual operations subsidy was to be split between the region’s counties and the state. The 50-50 share to make up for the difference between fares and actual costs has remained, often against Republican opposition.

Initially, the local government share of operations was via the consortium called the Counties Transit Investment Board that spent money pitched in from the five largest Twin Cities counties using their own transportation tax collections. After CTIB was dissolved, operating costs shifted to Hennepin and Ramsey counties and the state, based on how much of each light rail line was in each county. The contribution from the counties ended with the passage of the regional sales tax in 2023, so the Met Council covers half the operating costs and would pick up 100% if the Walz proposal passes.

Correction: This story has been changed to correct an error in describing the current split of operating subsidies. Met Council began paying half of the operating costs with the passage of the 2023 metro-wide sales tax. The story originally stated that the counties continue to pay that share.

Peter Callaghan

Peter Callaghan covers state government for MinnPost. Follow him on Twitter @CallaghanPeter or email him at pcallaghan@minnpost.com.